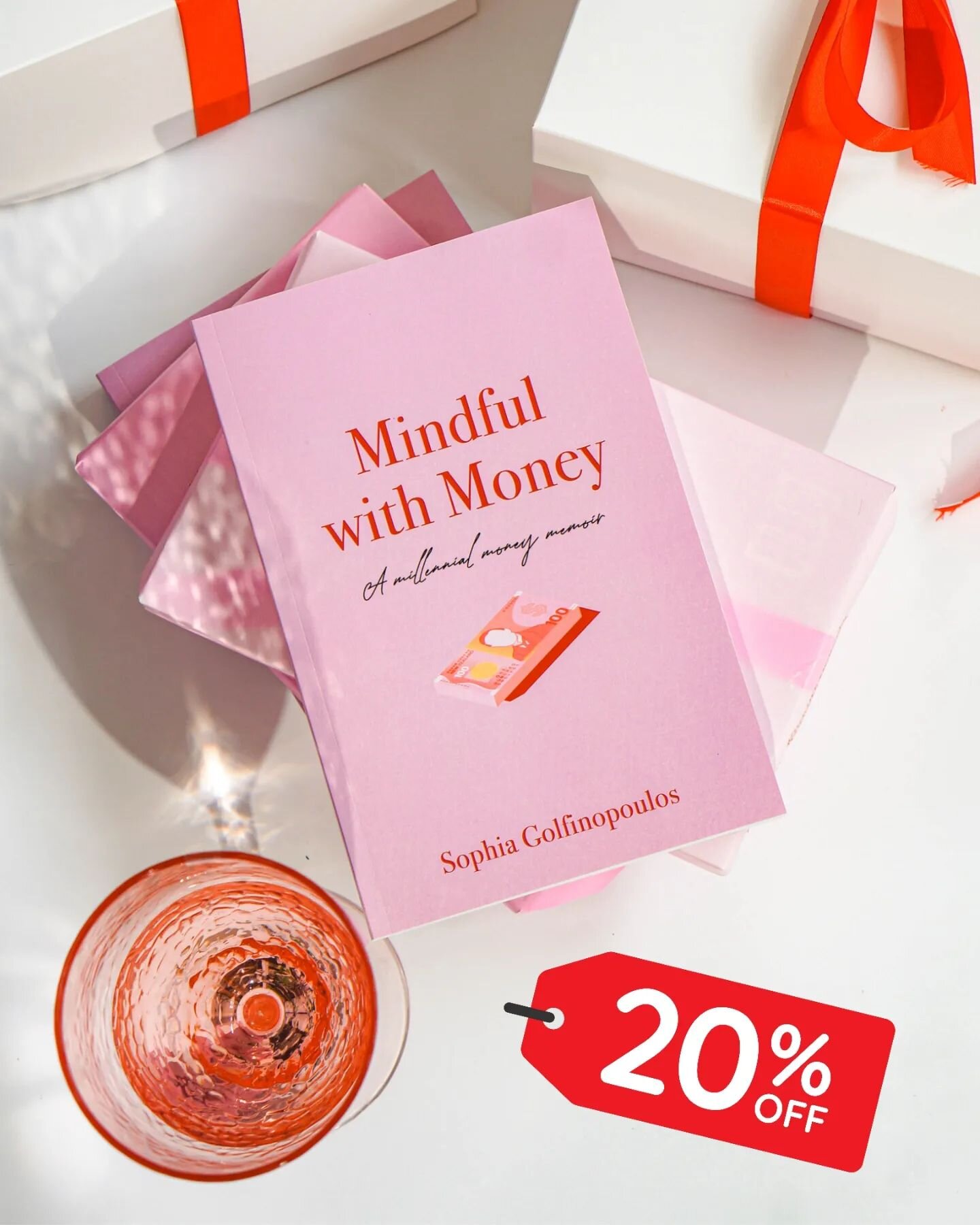

Welcome! I’m Sophia, the author of Mindful with Money. I’m passionate about all things personal finance, currently work in the NZ financial industry, and hold both a NZ Certificate in Financial Services (Life, Disability & Health Insurance; Residential Property Lending) and NZ Certificate in Personal Financial Capability. I hope my blog gives you plenty of helpful tips and inspiration on your own personal finance journey!

3 ways I’m paying off my debt faster

Becoming debt-free has always been one of my biggest personal finance goals - and last year, I got to say that I achieved this. It was the moment I received a letter from my finance company confirming that my car, a gorgeous red Mini Cooper, had officially been paid off!

For a time, I had no consumer debt - and it felt good not to owe anyone anything. Unfortunately, this didn't last too long because shortly after, I had to get several expensive dental treatments. Fortunately, my local dental clinic partnered with a finance company to offer interest-free finance for 6 months - so naturally, I went ahead for the sake of my oral health.

This interest-free finance felt like a personal loan, but technically, it was a credit card - and once issued, I was approved with a credit limit way higher than I needed. Seeing that they wanted me to spend more, accruing more interest, I reduced my credit limit immediately to help myself resist the temptation to spend. On top of this, here's 3 more easy, effortless ways that I'm paying off my debt faster that you may find helpful too!

Becoming debt-free has always been one of my biggest personal finance goals - and last year, I got to say that I achieved this. It was the moment I received a letter from my finance company confirming that my car, a gorgeous red Mini Cooper, had officially been paid off!

For a time, I had no consumer debt - and it felt good not to owe anyone anything. Unfortunately, this didn't last too long because shortly after, I had to get several expensive dental treatments. Fortunately, my local dental clinic partnered with a finance company to offer interest-free finance for 6 months - so naturally, I went ahead for the sake of my oral health.

This interest-free finance felt like a personal loan, but technically, it was a credit card - and once issued, I was approved with a credit limit way higher than I needed. Seeing that they wanted me to spend more, accruing more interest, I reduced my credit limit immediately to help myself resist the temptation to spend. On top of this, here's 3 more easy, effortless ways that I'm paying off my debt faster that you may find helpful too!

1. Creating an automatic payment - set to go out fortnightly.

Setting up an automatic payment means that I'm consistently paying down my debt, and it's so convenient to do so on your online banking - especially when you can choose your own day of the week and frequency. Mine goes out every second Thursday, aligned with the week of each fortnight when I receive my rental and job income.

But why fortnightly? It seems like there isn't much difference between paying fortnightly or monthly, so why not just pay monthly at double the fortnightly amount?

With fortnightly payments, you get to fit in a whole extra payment for the year! For example:

12 months x $200 = $2400 or 26 fortnights x $100 = $2600.

12 months x $100 = $1200 or 26 fortnights x $50 = $1300.

12 months x $150 = $1800 or 26 fortnights x $75 = $1950.

So if you can, set up your automatic payments or direct debits fortnightly. You'll save time, hassle, and potentially a lot of interest!

2. Refinancing at 0%.

Just before my 6 month interest-free period was up, I did a balance transfer. Shopping around, I was ecstatic to find that my bank had the best deal: a 0% balance transfer for 12 months. It was easy to transfer my credit balance across, especially knowing I was avoiding paying a high 25.99% interest rate!

So currently, my credit balance is sitting on a bank credit card (while the actual card itself is put away altogether), accumulating all of zero interest for a whole year while I take my time paying it off! There's still a minimum monthly payment every month of 2%, but the payments are extremely manageable.

If you have debt, I'd highly recommend taking 5 minutes to do a quick online search for any balance transfer specials banks are currently offering. It could be one of the best financial decisions you make; not only buying you time and saving you interest but giving you peace of mind. I'm certainly more relaxed with the steady pace I'm now able to go at.

3. Saving the change & zeroing out to increase repayments.

To pay off debt faster, you should always pay as much as you can over the minimum payment - and here's my favourite way to do it effortlessly. I call it 'saving the change' and 'zeroing out'.

It's incredibly easy to send extra repayments when your everyday account and credit card are with the same bank, especially when you can transfer payments instantly via their mobile banking app! From my knowledge, this goes for all NZ banks - ie. instant payments from ASB to ASB, from BNZ to BNZ, etc.

I love my instant payments. Every day, when I buy something or make a payment, I round up what I need and transfer it over, then pay the remaining difference to my credit card. I do the same for anything remaining in my everyday account at the end of the day. For example:

If I need to pay $24 for something, I transfer over $30, then send $6 (the 'change') to my credit card.

If I have $58.46 sitting in my everyday account at the end of the day, I'll send $8.46, $18.46 or $28.46 to my credit card and the rest (that's $50, $40, or $30 etc - all ending with a zero) to my 'Miscellaneous' account (what I named my on-call/flexi account).

The result? My credit card payments look extremely random, but since it's instant, I won't worry that there isn't some poor person manually processing each and every single one of my payments of $5, $12.50, $8.40 or $20.98! Yet, I can honestly say that it makes a huge difference because I do it often and consistently. I've actually paid off over $1000 without even noticing any difference in my life or feeling like I've made any sacrifices! Sometimes, if it's a day when I'm making a lot of payments (say I'm out grocery shopping, running errands, eating at a restaurant, or just paying a lot of bills), I even do it every few hours.

I hope you've enjoyed reading what I'm doing to pay off my debt faster and that these tips helped you too. Good luck!

Sophia

How to live on 80% of your income

When it comes to budgeting your money, it can be confusing to know where to start. How much should you be spending - and what should you be spending on? How much is 'normal' to spend on everything in your life, from your rent or mortgage, your car, entertainment and eating out?

If you have no idea where to start, or would just like to refresh your money mindset and give your budget a makeover, here's a super simple budgeting rule: the 50/30/20 rule.

When it comes to budgeting your money, it can be confusing to know where to start. How much should you be spending - and what should you be spending on? How much is 'normal' to spend on everything in your life, from your rent or mortgage, your car, entertainment and eating out?

If you have no idea where to start, or would just like to refresh your money mindset and give your budget a makeover, here's a super simple budgeting rule: the 50/30/20 rule.

If you have a 50/30/20 budget, that means that:

50% of your net income goes towards needs;

30% of your net income goes towards wants; and

20% of your net income goes towards your financial goals, like paying off debt or buffing up your savings.

Let's say that I bring home $1500 every fortnight. Ideally, my budget would look like this:

$750 (50%) for my needs;

$450 (30%) for my wants; and

$300 (20%) for my financial goals

So what does this mean? Because 50% goes towards needs and 30% goes towards wants, that means that 80% of your budget is allocated, leaving you with 20% to grow in your personal finance goals. Of course, if you can increase that 20% to 30%, 40% or more, even better! In an ideal world, right?

What it means for you is that you need to learn to live on 80% of your income. Here's how I did it, and you can too!

1. Know your net income.

A super easy first step! Your net income is not your salary, or gross income - like how you would normally say that someone's income is "$60k". It's what you take home. You don't need to calculate this; simply check your bank account for your weekly, fortnightly or monthly pay.

2. Work out 80% of your net income.

Sticking with the example of $1500 per fortnight, 80% of this means that ideally, you'd keep all your needs and wants within $1200 per fortnight. Or:

For $1400, $1120.

For $1200, $960.

For $1000, $800.

You get the idea.

If your needs & wants are under 80%, congrats! You do not need this blog. However, if your needs & wants are over 80%, my next step should help you out..

3. Reduce & simplify your needs & wants.

So your needs & wants are over 80% of your income. Let's see where your money is going and where we can reduce and simplify.

a) Write down what your needs & wants are. For me, my list looks like this:

NEEDS

Mortgage

Insurances

Power

Water

Internet

Phone

Fuel

Food

WANTS

Clothes

Books

Journals

Events

Food out

Subscriptions

b) Here is the time to question everything. Be ruthless with each expense! Ask yourself: "What can I do without, or get for less?"

Mortgage - can I refinance at a lower interest rate?

Rent - can I move somewhere with cheaper rent?

Insurances - can I switch to a policy with lower premiums (or increase excess)?

Power/Water/Internet - can I switch to a cheaper company?

Food - how can I eat nutritious food for less, or get more meals out of my food?

Clothes - how can I buy less clothes, or quality clothes that last longer?

Books - how can I spend less on books, or less often - perhaps by using my local library?

Gym - how can I work out and be healthy inexpensively, ie. switching gyms, going for walks in nature?

4. Do your research and save!

Now that you know where your money is going, it's easy to make change happen. Spend 30 minutes researching all your options, but remember: don't just look at the price, but the value you are getting. For example, another insurance company may provide a lower premium, but are you still just as protected and covered?

Here are all the things I have personally saved on:

My mortgage, by researching each bank's interest rates

My insurances, by comparing policies, premiums and excesses

My phone, by reducing my monthly data

Food - by making my food last longer (essentially halving my food portions)

Clothes - by buying new clothes less often, but at a much higher quality

Books - by going to the library and borrowing new books I want, instead of buying them straight away

Food out - by eating out less, and eating less meat when I do. Vegetarian & vegan options are just as delicious!

Subscriptions - by cancelling my LinkedIn Premium, Youtube Premium, and Skillshare, and sharing Spotify Premium with my partner

Gym - by selling my $49/fortnight gym membership and getting a $28/fortnight gym membership!

Once you shop around, you'll realise there are so many options out there; so many possibilities and ways to reduce your expenses. Simply repeat until your wants & needs are within that target of 80% of your income.

5. Work out your financial goals.

Success! You're now able to live on 80% of your income, and have freed up 20% for your financial goals. What are you going to do with all that money?!

Here are some ideas:

Pay off your debt. Challenge yourself to pay as much as you can above your minimum monthly payment.

Build your emergency fund - at least 3 months of your salary.

Buff up your savings.

Donate to a charity, organisation or political party you are passionate about.

Save for a big purchase, like a new car, laptop or holiday instead of borrowing from a credit card or personal loan.

Save towards your 10% or 20% house deposit!

So there you go - how to live on 80% of your income. I hope this has been helpful and informative and inspired you to refresh your budget.

Good luck!

Sophia

My personal home buying experience (Auckland, New Zealand)

In 2017, I ticked off one of my bucket list goals: to buy a freehold property. And by tick off, I mean literally – it had long been written in my kikki.k Bucket List Journal, alongside goals like ‘Go to Japan’, ‘Try anti-gravity yoga’, ‘Go to Tomorrowland in Belgium’ and ‘Fly a plane’. Needless to say, it was a dream come true.

After I shared the news, I got asked more or less the same questions from friends & acquaintances alike. So I’d love to share my home buying journey and what it was like, as a recount of my personal experience.

In 2017, I ticked off one of my bucket list goals: to buy a freehold property. And by tick off, I mean literally – it had long been written in my kikki.k Bucket List Journal, alongside goals like ‘Go to Japan’, ‘Try anti-gravity yoga’, ‘Go to Tomorrowland in Belgium’ and ‘Fly a plane’. Needless to say, it was a dream come true.After I shared the news, I got asked more or less the same questions from friends & acquaintances alike. So I’d love to share my home buying journey and what it was like, as a recount of my personal experience.The first thing I did was educate myself on KiwiSaver and how it can help you to buy your first home. I researched the eligibility criteria and house caps, then went ahead and applied for the HomeStart Grant. Since I’d been contributing to KiwiSaver for over three years, I was confident I’d be accepted. So when I received my pre-approval, I was ecstatic!As an individual, however, it was tough for me to find a house within the Auckland house caps – at the time, $600,000 for an existing property, or $650,000 for a new build. I felt discouraged after doing endless searches on Trade Me and never finding any houses that weren’t in the middle of nowhere, or tiny apartments with body corps.I subscribed to Trade Me’s email alerts by searching within my preferred region, local district, price range, and property type, saving the search, and choosing my preference on how often I wanted to be alerted of new listings. I repeated this email subscription process everywhere, including Property Press, where you can subscribe to the latest listings in the area you’re looking.I’d looked for a year or so before I gave up, then started looking again a few months later. This time, after months of searching on Auckland’s North Shore, I fell in love with several properties. A quiet unit in Hillcrest appealed to me for its simplicity and privacy, but unfortunately had a tandem garage. (Different to a double garage, I personally thought this would be a huge inconvenience.) I also loved a chic little unit in Milford, which while stylishly furnished with monochromatic decor, was in reality half of a home that had been split into two.How I found my future house was serendipity. On the same day I went to the Milford unit, I was almost not going to stop by another property, this time in Glenfield. But very luckily, I thought, ‘Might as well’, and went to view it. To my pleasant surprise, it wasn’t a unit this time, but a freehold, freestanding house!At first glance, it wasn’t very appealing. Unlike a lot of staged open homes, it was plain and unfurnished, so I wasn’t instantly enamoured with it as I had been with the previous properties. Once I took on a more logical and grounded perspective, in reality, it was absolutely wonderful: two spacious bedrooms with an open lounge & dining area. A carport that provides cover to the house. A kitchen with a generous amount of drawers, shelves & cupboards. (I found out later that a previous owner was a cabinet maker.) A front yard and deck, big enough to fit an outdoor dining table and lounge set. Additionally, it was in a fantastic location close to shops, eateries, bars, doctors, dentists, pharmacies, public transport, and more.Compared to countless homes on sale by negotiation or by auction, it was also refreshing to see a clear asking price of just under $700,000.At this point, it was time to prepare for the paperwork by finding a local solicitor and applying for the mortgage.The first thing I did was play around on my bank’s mortgage calculator, or home loan calculator. It works out approximately how much you could borrow based on your income, assets, debts, and expenses, plus what your repayments could be. I experimented multiple times to get an accurate idea. Then I called my bank for an appointment, asking, “I’d like to find out if I can get a mortgage – if I can, how much I can borrow, and if I can’t, what I would need to do to be able to.” At the time, I also had debt, which I disclosed straight away.I was lucky to be taken care of by a friendly, down to earth, and experienced banking adviser. She assured me my debt wasn’t actually very much in the grand scheme of things (phew!). Then she sent me an email with an application form, which I completed and sent back with my documents.The next day, she got back to me with good news: a conditional approval! Also called ‘pre-approval’, this allowed me to look at houses within a certain price range. (I remember her saying, “This is great news, I am so excited for you!” This genuine customer service made a huge difference and is something I still clearly remember and appreciate about one of the most significant purchases of my life.) It’s notable that the amount I could borrow was fairly accurate to the amount the online home loan calculator had told me, give or take a few thousand!After deciding on the house, it was time to negotiate. My house wasn’t on sale as an auction, but had an asking price. I’d cross-referenced different websites to get a rough figure of what the house was worth today, so I knew what was reasonable.That night, the real estate agent went back and forth between the vender and I while we negotiated the price. I increased my offer twice before I made my third and final offer. The vendor decided to sleep on it, which made that night a nerve-wracking and sleepless one.But the next day came – and they accepted!Now that it was on a conditional offer, I had to set some conditions. What conditions you set will be different for everyone. For me it was 1) a building inspection report and 2) a meth test. These were to be done within a certain time frame, which could be 7 days, 10 days, or any other time frame agreed between you and the vendor.Both passed satisfactorily, which meant that it was now unconditional!I went into the bank to get the mortgage set up and finalised. Personally, I preferred the certainty and ability to budget with a fixed mortgage rather than a floating mortgage, while half fixed, half floating was also an option. A huge bonus is still being able to make extra repayments on top of fixed monthly repayments, incurring early repayment costs of only cents! For me, it worked well.The bank’s condition was that we purchased home insurance, which was straightforward as I worked for an insurance company at the time, was familiar with the home insurance process, and received a discount.A lot of people are confused as to what to insure their home for. It’s not how much you bought the house for, but the rebuilding cost – how much you would need to rebuild the house if it was, for example, lost in a fire. However, it excludes land value. You can get a professional quality surveyor or find an online calculator. Note that what you want is a rebuild cost valuation, not a market valuation.The good news is, the rebuilding cost is usually significantly less than the purchase price – keeping your home insurance premiums low. You’ll also earn discounts if you have a securely monitored alarm, have an owner occupied property, or combine your home insurance policy with your contents & car insurance policies.I paid my deposit, which was 10%, and waited for the settlement date, which had been decided earlier on the night we negotiated the price. On settlement day, the rest of the funds were paid from the bank to my solicitor, which were then paid to the vendor’s solicitor. I met up with the real estate agent to collect the keys, and arranged to get power, water, and internet up and running. The official Sale & Purchase Agreement was emailed through, naming me as the owner of the house in North Auckland!In the end, I didn’t use my KiwiSaver HomeStart Grant because the price was above the house caps, but what I did make good use of was my KiwiSaver First Home Withdrawal. You can withdraw your entire balance, minus $1000, and that’s exactly what I did. Here are just a few things I wish I’d done earlier:Saved more to borrow less – a pretty obvious but crucial one, especially with interest to take into account.Had a higher Kiwisaver contribution rate. I was on the default of 3%, and have since increased it to 8%. If I were to do it again, I’d increase it to the new maximum rate of 10% if possible.Been more patient and persistent – it takes time to find The One.Considered all the factors and looked at the fine details (ceilings, walls, window sills, things in need of repair etc). It’s a great idea to bring along your partner, friends and family to view a property. They may notice things you don’t see!Considered a buyer’s agent. Buyer’s agents are like real estate agents, except they work for you and act in your best interest, not the seller’s. They also liaise on your behalf, potentially saving you many time consuming drives, phone calls, negotiations and headaches.

I hope that this was helpful to you! Check out the resources I used below:+ Housing New Zealand – Ways We Can Help You to Own a Home (including KiwiSaver)+ Trade Me Property and Property Press – remember to save your search + sign up for email alerts if you wish.+ Sorted Mortgage Calculator – I used my own bank’s one, but to be impartial I’ll link this one, which is just as helpful. It’s a good idea to shop around the banks to see if they have any special promotional rates or rewards currently going – from what I've seen, you could score a holiday, earn extra cashback or score a discounted banking + insurance package!+ Electric Kiwi – Their customer service was amazing. Electric Kiwi, an independent and 100% online company, got my power up and running - remotely - in less than 30 minutes after a quick online chat.+ Settled.govt.nz – Brought to you by the Real Estate Authority (REA), this is a new website that guides New Zealanders through buying or selling your home. I discovered this from my volunteer work at Citizens Advice Bureau, where volunteers like me are happy to help you with any questions you may have about the home buying process - or just about anything, really!If you are an aspiring homeowner, good luck, and I wish you all the best!Sophia